Switzerland’s SIX Digital Exchange (SDX), the world’s first fully regulated Financial Market Infrastructure offering issuance, listing, trading, settlement, servicing, and custody of digital assets today welcomes SIX SIS as a new member on its Central Securities Depository (CSD).

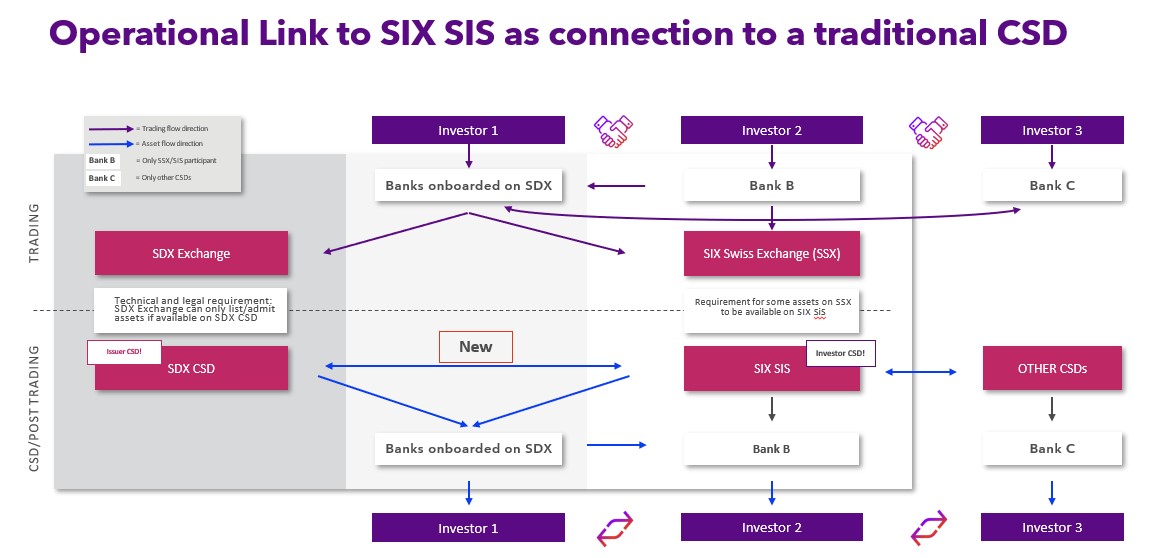

SIX SIS is the first regulated CSD to have direct access to SDX, which will increase the accessibility of natively digital CHF-denominated bonds to the wider market. The operational link announced today will enable investors to purchase a digital bond and hold it in SIX SIS.

According to David Hatton, Head Digital Securities at SDX: “This new operational link between SDX CSD and SIX SIS enables digital CHF bonds natively issued on SDX CSD to be held and settled at SIX SIS. This in turn opens future digital bond issuance to the broader CHF investor base, whilst laying the platform for a fully integrated CHF denominated digital bond market.”

See the visual explanation here:

About SDX

SDX is licensed by Switzerland’s financial market regulator, FINMA, to operate an Exchange and a Central Securities Depository (CSD). SDX offers issuance, listing, trading, settlement, servicing, and custody of digital securities.

SDX is committed to working with partners, members, and clients to promote and build a new market structure for digital assets globally.

About SIX

SIX operates and develops infrastructure services for the Swiss and Spanish Stock Exchanges, for Post-Trade Services, Banking Services and Financial Information with the aim of raising efficiency, quality and innovative capacity across the entire value chain of the Swiss and Spanish financial centers. The company is owned by its users (120 banks). With a workforce of 3,685 employees and a presence in 20 countries, it generated operating income of CHF 1.5 billion and Group net profit of CHF 73.5 million in 2021. www.six-group.com