SDX Group (SDX) operates the world’s first fully regulated digital exchange and Central Securities Depository (CSD) built on Distributed Ledger Technology (DLT) out of Switzerland.

Members of the SDX network can issue, trade, and store digital bond tokens on a trusted and secure DLT platform. Digital bonds are redefining the lifecycle of bond issuance and SDX provides you with the infrastructure to lead this transformation.

As part of SIX Group, one of Europe’s leading financial market infrastructure providers, we adhere to the highest operational and security standards. We understand the importance of customer protection, a clear governance framework, and regulatory obligations in the digital asset space, ensuring that our platform operates with the highest level of trust and compliance.

Our CSD (SDX CSD) runs on DLT, which is the heart of the digital market infrastructure of the future. While drawing from elements of the broader blockchain space, the SDX ecosystem presents distinct nuances. SDX CSD is fully regulated by the Swiss Financial Market Supervisory Authority FINMA, and it operates on a private permissioned network composed of banks and securities firms.

Together with you, syndicate banks can issue native digital bonds based on Swiss law. Digital bonds can settle against tokenized CHF on chain, where they are securely stored in cryptographic wallets for end investors.

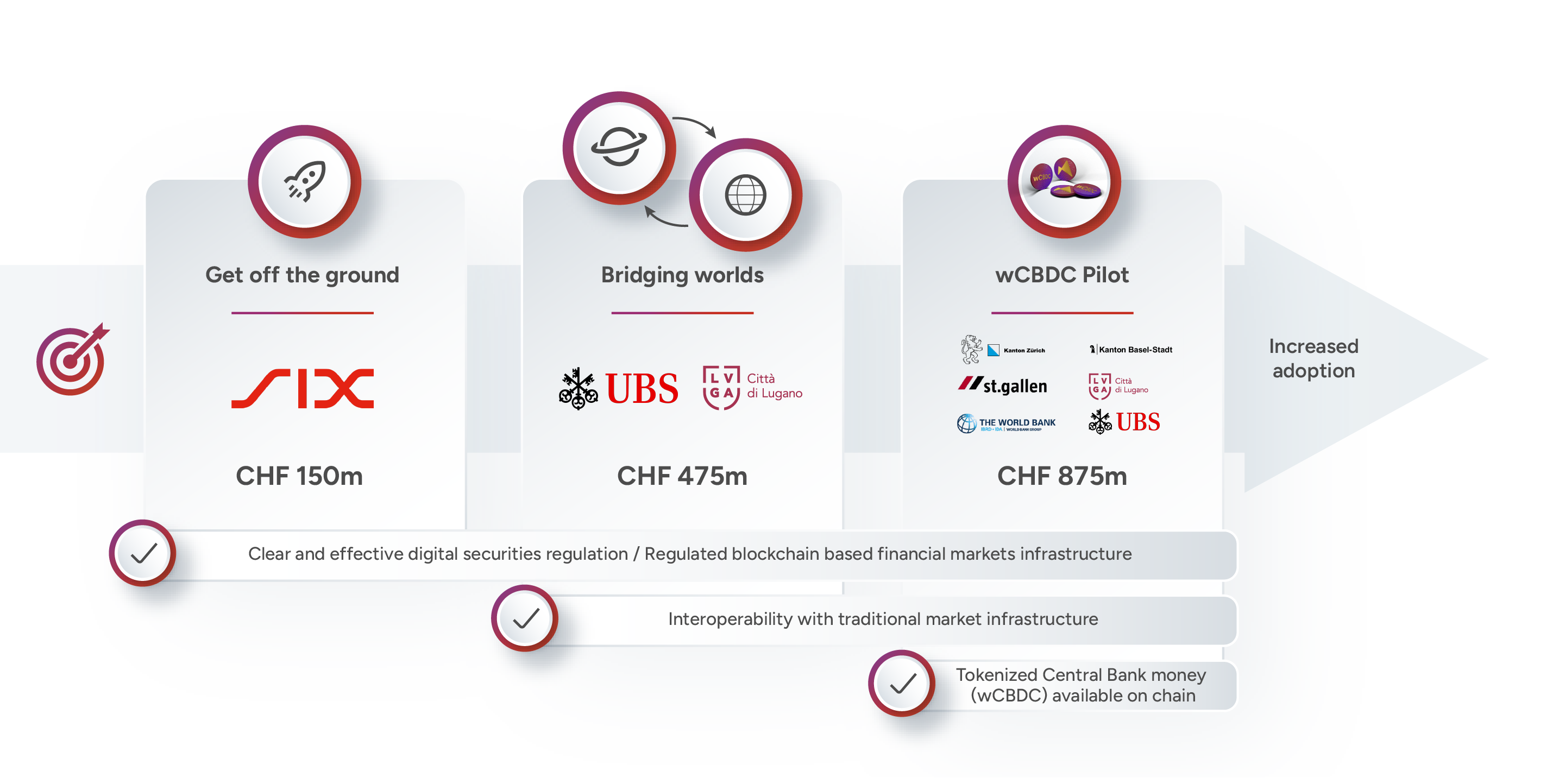

At SDX, we are on a path with incremental steps towards the widespread adoption of digital securities — and you can be part of it. Digital bonds have been at the forefront of the digital evolution within the Swiss financial market, proving to be a key element in testing and advancing Distributed Ledger Technology. With the framework for digital securities equivalency in place, SDX is positioned to scale and take digital bonds to the next level.

Digital bonds issued through SDX remain accessible to the entire investor base, ensuring broad market participation.

With SDX’s dual listing capabilities, bonds can live in both the digital and traditional world, making them resilient to market changes while maintaining engagement with traditional market players.

Transition to the digital world without disruption. Issuers can maintain existing workflows for CHF bond issuance while benefiting from digital innovations.

SDX CSD built on blockchain technology enables faster and more secure transactions.

Digital bonds issued on SDX come with immutable transaction records, improving trust and accountability through transparent and traceable transactions.

With atomic settlement, counterparty risk is eliminated, as transactions are processed simultaneously for both delivery and payment, ensuring immediate and secure settlement in secondary market trading.

Get in touch so we can demo our platform and show our services in more detail.